Spring time is here, and unfortunately tax time goes hand in hand with Spring. For those of you who don’t know, between my husband and I we own 5 companies which means 6 sets of books between all of those. I also have a background in mortgage finance, and took my job of advising my clients with their finances very seriously.

I manage most of the admin for our little Taylor enterprise, which makes this time of the year an interesting one! For those of you who have either filed an extension or wait until the last minute, there are a few things that I do to ensure I make the most of tax deductions that I want to share with you!

1. Charitable donations are an amazing way to save money in taxes while helping others. The best way to track these and avoid penalties in the case of an audit is to keep good records.

- Any monetary donations are best made by check or credit card so you automatically have a receipt with the cancelled check or the credit card statement, but each company should give you a statement at the end of the year.

- In your book keeping software, categorize church donations separately from other donations since they are put on their own line on your tax return. I personally have a main “Charitable donations” category, then subcategories of “In kind donation”, “Charities” and “Church”.

- For in kind donations of clothing or any other goods, I recommend photographing the items that you are donating and make an itemized list where you put the value of each donated item and calculate the total value of the donation. You can use this these printable value guides from Goodwill or Salvation Army as your guidelines which will back up your valuation of your donation in the case of an audit.

- Store the photographs, itemized list and receipt all together either by scanning them in to online digital storage or in a physical file set aside for tax receipts.

- For digital storage I like to use either Dropbox for organized storage in folders or Neat receipts which is a software that will organize your receipts for you as you scan them. Neat is absolutely my favorite because it takes so much of the work out of organizing. They have scanners and an app so you can photograph your receipts from your phone and store everything in their cloud.

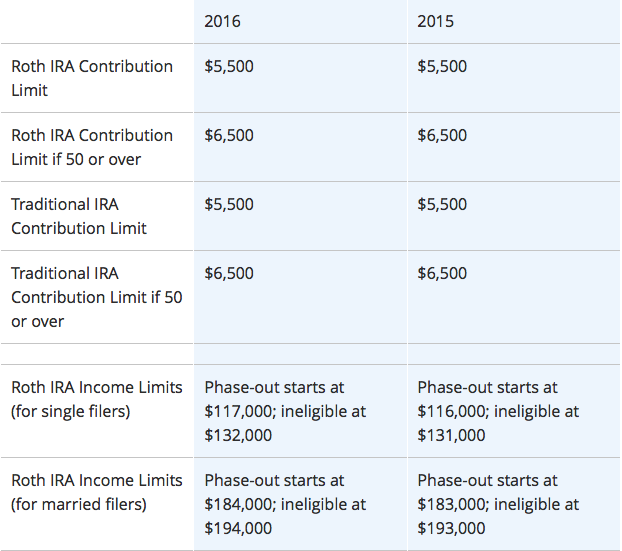

2. Retirement contributions are allowed for 2016 until April 15th, 2017.

- If your income threshold is below the maximum allowed for a Roth IRA, I highly recommend that you contribute to that. Pay the taxes now, and let your money grow tax free. Trust me, you can save yourself thousands in tax savings when it is time to cash in on your IRA in retirement. This is a great little graphic.

- If your income is too high for a Roth, or you have maxed out the contribution limit, then contribute as much extra to your retirement accounts as possible. You will pay taxes on that money when you take your distributions later on.

3. If you are a home owner and did any improvements to your home in 2016, make sure that you add all of the expenses up, or categorize them to your home improvement category in your software. Many people forget to inform their CPA about these expenses.

4. This may be obvious to some of you, but not everyone is using a book keeping software like YNAB (You Need a budget), Quicken or Mint.com. Using one of these and categorizing every transaction is the #1 best way to capture any tax deductible expenses without handing a shoebox full of receipts to your CPA. He will thank you, and you will thank me when you see how much easier it makes tax time. ?

- Set up your categories in to a master category DEDUCTIBLE EXPENSES and then set up all of the subcategories such as medical expenses, charitable expenses, etc. below that. This way when you pull an income and expense report, it is in a nice and tidy list for your CPA.

- These are two great articles on the basic list of itemized deductions & how you can deduct workplace expenses

- Don’t forget Mortgage interest and property tax deductions.

- If you are required to work from home, you may also qualify for home office expenses. Be sure to ask your CPA if you qualify.

5. I highly recommend a side hustle in order to qualify for Schedule C deductions. What do I mean by side hustle? An Etsy store, selling Herbalife, or any other venture that makes a bit of income. This immediately allows you to deduct a whole bunch of expenses that you can’t deduct as an employee. This won’t help you for 2016, but you can get started now to create deductible expenses in 2017.

The more you do to organize yourself throughout the year, the less time it will take out of your normal life at tax time. Also the more informed you are about ways to maximize your tax savings, throughout the year, the better.

That’s it for now! I’m excited to have that all behind me so I can get back to being creative, which is my favorite thing to do.

P.S. One or two of the links in this post may be to an affiliate link, which is like a virtual tip jar….a sweet little nod and a thank you, if you will. You are not obligated to use that link to purchase the product. You may go directly to the link on your own if you prefer. 😉